Empowering Entrepreneurs. Transforming Communities.

At Axe Micro-Enterprise Ltd., we believe financial empowerment starts with access. Our mission is to make credit affordable, responsible, and available to every hardworking Kenyan — from informal traders to smallholder farmers — unlocking opportunities for growth, resilience, and prosperity.

01

Building Financial Inclusion

Creating pathways for people excluded from traditional finance.

Across Kenya, millions of entrepreneurs run informal businesses without access to affordable working capital. Axe Micro-Enterprise bridges this gap through digital credit solutions that are fast, flexible, and fair.

Driving Digital Connectivity

Connecting people to the power of digital finance.

We leverage mobile technology to make credit access as easy as a tap. Every loan builds a digital financial footprint — enabling customers to grow their credit history, transact safely, and access additional services.

Fueling Growth and Prosperity

Turning ambition into action through responsible credit.

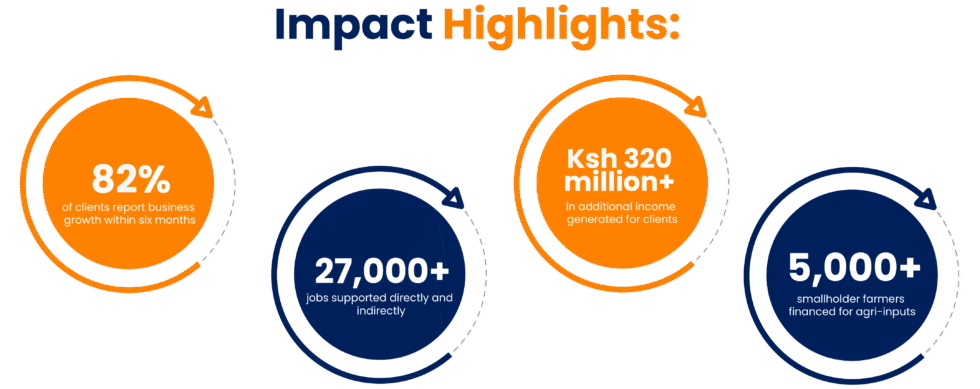

Our financing helps clients restock shops, purchase farm inputs, expand kiosks, and invest in their future. Each loan is a seed — one that grows into stronger incomes, thriving families, and healthier communities.

04

Supporting Sustainable Livelihoods

Championing long-term financial wellbeing.

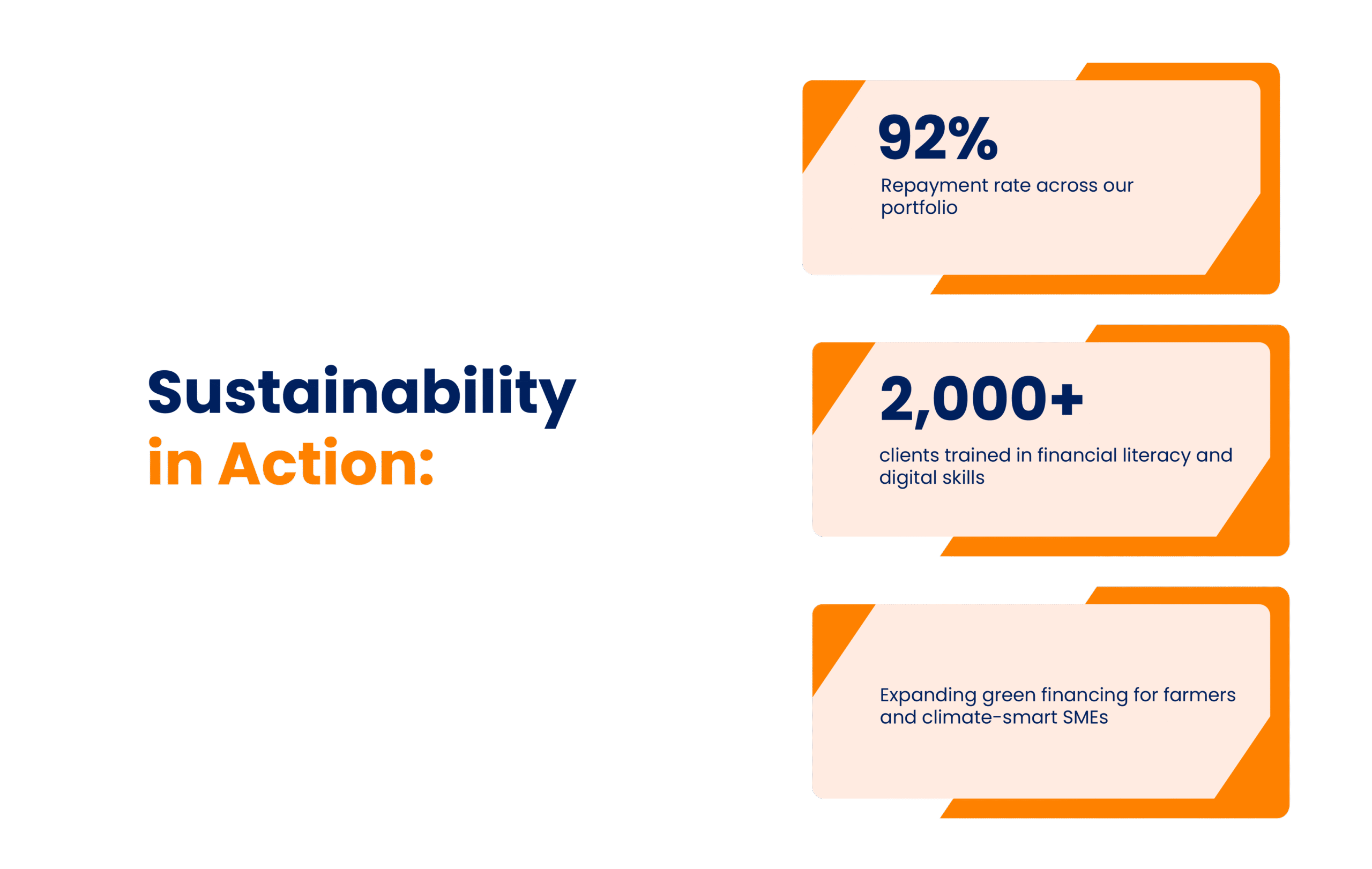

We are committed to building responsible, lasting impact. By promoting timely repayments, financial literacy, and progressive loan limits, we ensure clients grow sustainably — not just quickly.

Inclusive. Flexible. Progressive.

Inclusive

Our digital credit solutions serve everyone — from youth hustlers to market traders and rural farmers — with minimal paperwork and zero collateral.

Flexible

Our digital credit solutions serve everyone — from youth hustlers to market traders and rural farmers — with minimal paperwork and zero collateral.

Progressive

Good repayment builds trust — unlocking higher limits and access to value-added services like insurance and savings products.